High Voltage Switchgear Market to reach USD 30.32 Billion by 2032 | at 4.46% CAGR: Report by SNS Insider

High Voltage Switchgear Market is growing with demand for reliable power distribution, driven by grid modernization, renewable energy, and industrial expansion.

AUSTIN, TX, UNITED STATES, February 11, 2025 /EINPresswire.com/ -- Market Size & Industry Insights

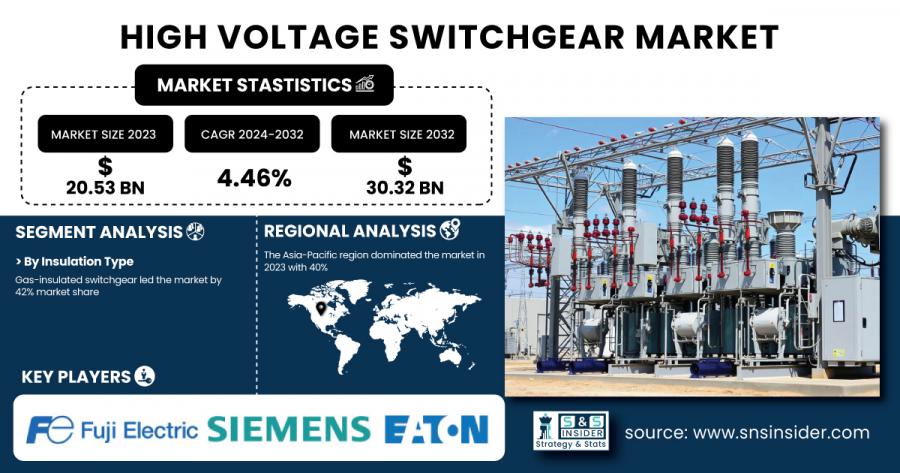

According to the SNS Insider Report,“The High Voltage Switchgear Market size was valued at USD 20.53 Billion in 2023 and expected to reach USD 30.32 Billion by 2032, growing at a CAGR of 4.46% during 2024-2032.”

Driven by increasing need for reliable and efficient electrical infrastructure due to urbanization, industrialization, and integration of renewable energy. The growing emphasis on power grid modernization and smart grid technologies is also driving the need for advanced switchgear.

Get Free Sample PDF of High Voltage Switchgear Market (with Full TOC & Graphs) @ https://www.snsinsider.com/sample-request/2884

SWOT Analysis of Key Players as follows:

- ABB Ltd.

- Siemens AG

- General Electric

- Schneider Electric

- Eaton Corporation

- Mitsubishi Electric Corporation

- Hitachi Energy

- Toshiba Corporation

- CG Power and Industrial Solutions Ltd.

- Hyosung Heavy Industries

- Alstom

- Lucy Electric

- Powell Industries Inc.

- Meidensha Corporation

- Ormazabal

- Tavrida Electric

- Nissin Electric Co. Ltd.

- Hyundai Heavy Industries

- Fuji Electric Co. Ltd.

- CHINT Group

By Insulation Type, Gas-insulated switchgear dominating and air-insulated switchgear Fastest Growing

Gas-insulated switchgear (GIS) led the market with a 42% share in 2023, due to its space-saving design, increased operational efficiency, and ability to function in harsh climates. Sulfur hexafluoride (SF6) is used to insulate circuit breakers in GIS, allowing for arc-quenching and insulation capabilities superior to conventional substation equipment and for much smaller footprints, making GIS ideal for urban and industrial applications with finite space. Such as Siemens' 8DQ1 GIS used in high-voltage power systems.

Air-Insulated Switchgear (AIS) is gaining traction from 2024 to 2032 due to its lower cost and reduced maintenance. Affordability and Eco-community Concept Schneider Electric's PIX AIS is often employed in power distribution and infrastructure.

By Product Standard, IEC Standard Dominating and ANSI Standard Fastest Growing

The IEC Standard segment held 54% of the market in 2023, driven by its global recognition and widespread use in Europe, Asia, and other regions, ensuring safety, reliability, and efficiency in power distribution. Companies like Siemens and ABB develop switchgear products based on IEC standards.

The ANSI Standard segment is expected to grow rapidly from 2024-2032, owing to the requirements of business operators within the regulatory landscape of the U.S. and adjacent regions, where switchgear manufacturers such as General Electric are producing switchgear in compliance with ANSI standards for North American utilities and industrial projects.

Connect with Our Expert for any Queries @ https://www.snsinsider.com/request-analyst/2884

By Component, Circuit breakers Dominating and Relays Fastest Growing

Circuit breakers dominated the market in 2023 with a 35% share, due to their ability to stop the flow of electric current during malfunctions, thus safeguarding the electrical system. With the growing power demand and renewable energy adding to the grid, the utilisation of advanced solutions from companies such as Schneider Electric are on the rise to be integrated within substations and industrial applications.

Relays are expected to grow rapidly from 2024-2032, driven by the rise of smart grids and energy-efficient solutions. An example of this is Siemens protective relays that protect the power generation and distribution by ensuring more operation that is reliable and minimum downtime.

By Application, Transmission and Distribution Network Dominating and Manufacturing & Processing Fastest Growing

The Transmission and Distribution Network segment leads the High Voltage Switchgear Market, driven by the growing demand for efficient power transmission, renewable energy integration, and modernized grids. This segment benefits from the need for high-capacity infrastructure.

Manufacturing & Processing segment is expected to grow the fastest due to rising demand for industrial automation, energy-efficient solutions, and the expansion of industrial facilities requiring robust electrical systems. These trends highlight the evolving needs for reliable and efficient electrical solutions in both sectors.

KEY MARKET SEGMENTS:

By Insulation Type

Gas Insulated

Oil Insulated

Air Insulated

By Product Standard

IEC Standard

ANSI Standard

By Component

Circuit Breakers

Relays

Switch

Other

By Application

Transmission And Distribution Network

Manufacturing & Processing

Infrastructure &Transportation

Purchase Single User PDF of High Voltage Switchgear Market Forecast Report @ https://www.snsinsider.com/checkout/2884

Regional Insights and Market Dynamics in High Voltage Switchgear Market

The Asia-Pacific region led the High Voltage Switchgear Market in 2023 with a 40% share, driven by rapid urbanization, industrialization, and rising electricity demand. Countries like China and India are investing heavily in electrical infrastructure, spurring the need for switchgear. Key players such as Siemens and ABB are leading the market in offering advanced solutions for power generation, transmission, and distribution.

North America is expected to experience the fastest CAGR of 4.85% from 2024-2032, to the increasing need for a better urbanization planning along with renewable energy projects, with industry giants like General Electric and Schneider Electric driving the innovation for the market.

TABLE OF CONTENT - Key Points

Chapter 1. Introduction

Chapter 2. Executive Summary

Chapter 3. Research Methodology

Chapter 4. Market Dynamics Impact Analysis

Chapter 5. Statistical Insights and Trends Reporting

Chapter 6. Competitive Landscape

Chapter 7. High Voltage Switchgear Market Segmentation, by Insulation Type

Chapter 8. High Voltage Switchgear Market Segmentation, by Product Standard

Chapter 9. High Voltage Switchgear Market Segmentation, by Component

Chapter 10. High Voltage Switchgear Market Segmentation, by Application

Chapter 11. Regional Analysis

Chapter 12. Company Profiles

Chapter 13. Use Cases and Best Practices

Chapter 14. Conclusion

Continued…

Make an Inquiry Before Buying @ https://www.snsinsider.com/enquiry/2884

Akash Anand

SNS Insider

+1 415-230-0044

info@snsinsider.com

Distribution channels: Electronics Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release