By the Numbers: How Companies Pay Execs They Promote to CEO

Choosing the right candidate to fill the corner office comes with a unique set of challenges. Putting aside the search for expertise and business acumen, leadership style, cultural fit, and a host of other considerations, one consistent — and expensive — factor is, of course, compensation for newly appointed chief executive officers (CEOs).

WTW’s Global Executive Compensation Analytics Team (GECAT) explored promotions among S&P 100 companies since 2020 to identify typical practices followed when promoting a new CEO from within the existing executive team. This analysis, different from the GECAT’s recent analysis of pay for interim CEOs, revealed the circumstances for each company and the different approaches taken. Here’s what the team found, by the numbers.

Where new CEOs come from

Historically, 80% of new CEOs are promoted from within as opposed to being externally recruited. As such, the GECAT analysis focuses on promoted CEOs rather than externally recruited professionals.

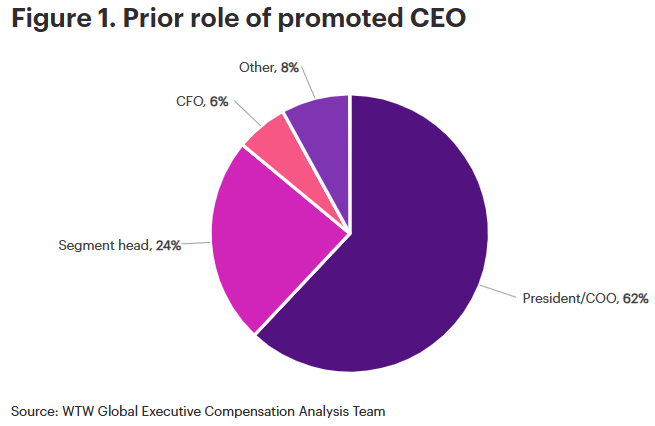

As shown in Figure 1, prior to their promotion, most promoted CEOs were in the President and/or COO position, or were from the segment or regional business unit, or came from some other unspecified executive function (e.g., vice chair, executive vice president, noted as “Other” in the chart).

Figure 1. Prior role of promoted CEO

Reviewing and benchmarking pay

Increases to salary, annual bonuses and long-term incentives (LTIs) are part and parcel of new-CEO compensation. If a promotion is timed to coincide with the end of the fiscal year and corresponding compensation decisions, pay at promotion may be limited to those comp-adjustment decisions that are only associated with the new role.

Timing of service in the role prior to being promoted — particularly among those who previously served as president and/or COO — also factors into pay adjustments. As shown in Figure 2, pay increases for longer-tenured executives are less than those for shorter-tenured peers. This may be because longer-serving presidents/COOs typically are paid closer to the outgoing CEO than those who served for one year or less prior to promotion.

| President / COO (more than 1 year) | President / COO (1 year or less) | All other positions | All executives | |

|---|---|---|---|---|

| Percent difference of promoted CEO pay vs. pay in former position | 49% | 63% | 37% | 55% |

| Percent difference of promoted CEO pay vs. former CEO pay | -19% | -37% | -26% | -28% |

| Prevalence of promoted CEO one-time promotion awards | 42% | 44% | 54% | 47% |

| Value of promoted CEO one-time promotion awards | $2.0 million | $4.2 million | $4.3 million | $4.1 million |

| (Number) | 12 | 9 | 13 | 34 |

Figure 2: Promoted CEO one-time awards and pay in relation to former role and the former CEO*

*Based on annualized total target direct compensation at the median.

However, not all promotions can be timed to align with the annual pay cycle. In these cases, one-time awards may be considered to close gaps in pay or to true-up pay for ongoing performance cycles to match the new role, effectively accounting for service time in two roles across performance periods.

Promotional awards may not necessarily have the same terms and conditions as a company’s annual or LTI program, as they are typically awarded to signify the promotion or help align stock ownership and incentives with the new role. By the numbers:

- 47% of promoted executives received a one-time award upon their appointment as CEO; only one organization paid in cash rather than equity. Of this larger group, 70% were granted consistent to the company’s regular LTI program, with time or performance vesting typically measured over three to four years.

- 30% of promoted CEOs received one-time promotional LTI awards, with time and performance horizons stretching from five to 10 years, characterized as inducement grants or front-loading compensation in lieu of future considerations.

All things considered

When compensating a newly promoted CEO, organizations should understand how the timing of the promotion fits with the regular compensation cycle. It’s also important to understand whether the promotion requires or supports awarding supplemental compensation at the time of promotion.

Promoting from within provides more certainty than recruiting an external candidate. However, based on the GECAT’s analysis, even after a structured succession plan, each promotion is unique. This provides organizations an opportunity to think about what makes the most sense from a compensation design and delivery perspective.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release