CBA customers hit by transfer glitch, ASX finishes the day higher — as it happened

Commonwealth Bank customers reported problems with electronic transfers from their accounts, while stock markets digested the latest US tariff developments.

US stocks gained despite an appeals court ruling that has, at least temporarily, reinstated the Trump administration's "Liberation Day" tariffs on virtually every nation.

Australian stocks also gained, finishing the day up +0.3% at 8,435.

Look back on the trading day with the ABC business and markets blog.

Disclaimer: this blog is not intended as investment advice.

Submit a comment or question

Live updates

ASX closes up

The Australian share market has finished the day up 0.3% at 8,435 points with an almost even split of winners and losers.

Overall, the market had 92 stocks in the red, 11 unchanged and 97 stocks gaining.

When looking at the sectors, Utilities finished at the top; up 1.2%, followed by Consumer Non-Cyclicals; up 1%.

The Energy sector finished at the bottom; down -1.4%, followed by Industrials; -0.8% and Technology; -0.77%.

Among companies, the top mover was Ramsay Health Care, up +5.9%, followed by West African Resources, up +5.6%.

It wasn't a good day for Pilbara Minerals, finishing down -5.7%.

IGO was also down at -5.4% and Lottery Corporation down -5%.

The Australian dollar is pretty flat, down -0.25% at 64.25 US cents.

That's it from The Business Team today - have a great weekend and we will see you nice and early on Monday!

LoadingAviation industry impacted by trade wars

The airline industry is concerned that geopolitical uncertainty will decrease travel demand by consumers and therefore raise costs.

According to Reuters, US President Donald Trump's on again, off again trade war has upended the aerospace industry's decades-old tariff-free status and added a new later of volatility.

The U.S. sector has been hit the hardest by a recent slump in travel demand, with carriers unable to forecast passenger behaviour and operational costs.

The influential International Air Transport Association (IATA), which represents more than 300 airlines and over 80% of global air traffic, is holding its annual three-day meeting from Sunday in New Delhi, with geopolitics high up on the agenda.

Trump Tower in Vietnam

According to Reuters, investment in a planned Trump Tower in Vietnam is estimated at around $1 billion, with construction of the skyscraper likely to start next year.

The at least 60-storey building will be the second major project the Trump Organisation is reviewing in Vietnam.

The Southeast Asian country is currently in trade talks with Washington to avoid crippling 46% tariffs.

Japanese company to spend $6 billion on decarbonisation efforts

Japanese steel manufacturing company Nippon Steel is planning to invest nearly 870 billion yen ($9.4 billion) to introduce electric furnaces at its three domestic plants to reduce carbon emissions, according to Reuters.

In a statement from the company, the Japanese government plans to subsidise around 251 billion yen of the steelmaker's decarbonisation effort focused on the three plants by the 2029 fiscal year.

Following the investments, Nippon Steel will add around 2.9 million metric tons of new steel production capacity, it said.

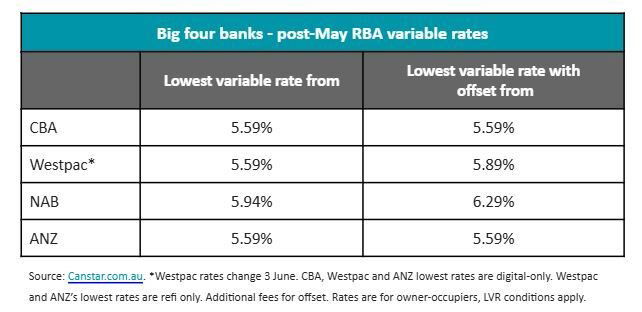

Three big banks have dropped variable rates

Three of Australia’s biggest banks – CBA, NAB and ANZ – have each dropped variable rates today by 0.25 percentage points, following the RBA’s May cash rate decision earlier this month.

According to Canstar, this means that millions of Australians with a variable mortgage will be charged less interest from today.

Westpac variable home loan customers will not have rates changed until Tuesday 3 June.

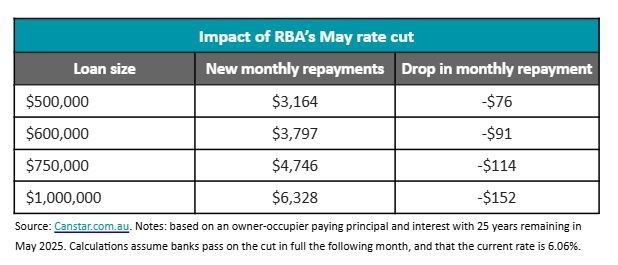

Analysis from Canstar shows for an owner-occupier with a $600,000 debt and 25 years remaining on the loan, their minimum monthly repayments could drop by an estimated $91 as a result of the RBA’s cash rate cut earlier this month.

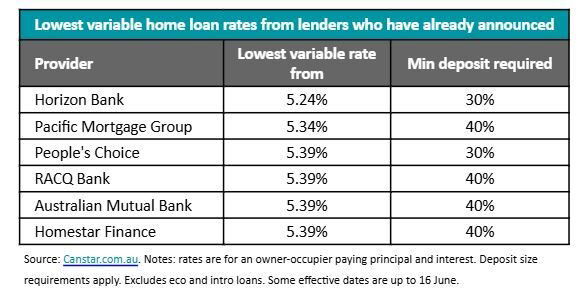

Currently, Horizon Bank has the lowest variable home loan rate.

YIMBY movement urges greater taxation of Rosehill Racecourse

The Sydney branch of the Yes In My Backyard (YIMBY) movement, which wants more and denser development to push up housing supply in an effort to push down prices, has slammed the Australian Turf Club's decision not to sell its Rosehill Racecourse site.

The NSW Government wanted to buy the land to on-sell to developers who were expected to build 25,000 homes, and it planned to put a stop on the new west metro line there to provide transport to those new residents.

After the narrow vote by ATC members against the sale, Sydney YIMBY is urging the turf club to be taxed on the land at rates that more closely match its potential value, if put to a more valuable use.

For more background on the story, you can read the piece for our NSW newsroom via the link below.

HESTA super back online on Monday, June 2

HESTA superannuation will be back online next week after a seven-week planned outage to change administration providers.

The ABC has been reporting on HESTA, one of Australia's largest super funds, over the last two months and has heard from dozens of Australians struggling with the outage.

This week, one woman told the ABC she was relying on her superannuation to pay for her spinal surgery next month, and when her application wasn't addressed by HESTA because of the outage, she almost had to cancel.

She said she was lucky a friend gave her some money to borrow until she can access her super account again.

HESTA has told the ABC, "we're continuing to support our members through this period of change as we know that, while in the short-term it may be challenging, this transition will provide the technology platform and data capabilities to better service our members in the years ahead".

CAB says online banking issues have been fixed

In developing news, Australia's biggest bank now says it has fixed the issues some of its customers were experiencing today.

Online banking customers started getting an error message this morning, saying there were issues with transferring cash externally using PayID or BSB accounts.

CBA maintained people could still make payments using their cards or get cash out at ATMs.

It now says it's fixed the issue and services are restored.

"We are sorry for the inconvenience and thank customers for their patience," a statement to ABC News reads.

Are you a bank customer that has issues? Email me on terzon.emilia@abc.net.au

Market snapshot before we close the blog this afternoon

- ASX 200: +0.3% to 8,435 points

- Australian dollar: Down at 64.26 US cents

- S&P 500: +0.4% to 5,912 points

- Nasdaq: Flat at 21,364 points

- FTSE: -0.1% to 8,716 points

- EuroStoxx: -0.2% to 548 points

- Spot gold: -0.7% to $US3,293/ounce

- Brent crude: -0.4% to $US63.89/barrel

- Iron ore: +0.2% to $US99.30/tonne

- Bitcoin: -0.2% to $US106,033

Prices current around 14:30 AEST.

Spotlight on China's economy

With all the geopolitical trade tensions, pundits are watching the Chinese economy closely.

Analysts at ANZ have predicted China's upcoming exports for May will be 4.4% year on year, down from 8.1% in April.

Modelling by ANZ's Vicky Xiao Zhou and Raymond Yeung suggests North Asian supply chains remain strong as trade data of South Korea and Taiwan are best predictors of China’s exports.

"We also find that the correlation between Vietnamese imports and Chinese exports is similar before and after Trump 1.0, suggesting that the impact of rerouting activity may be overplayed."

China-watchers will be keeping a close eye on key data out in the coming weeks, including manufacturing PMI and China-US export data.

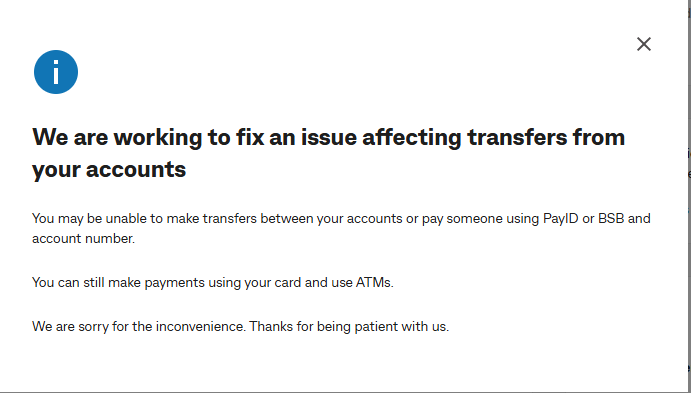

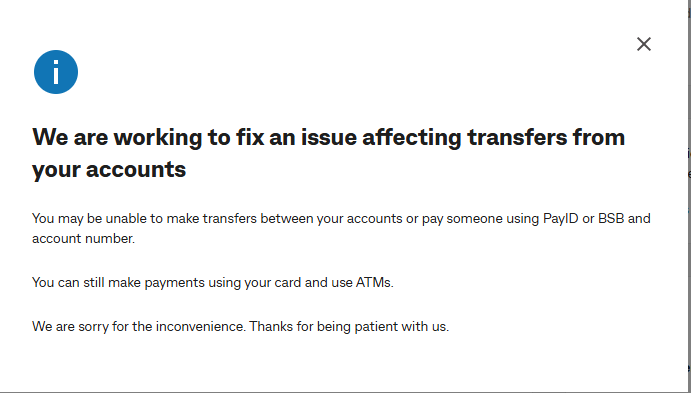

Commonwealth Bank confirms transfer problems

A statement is in from Combank about the problems customers are experiencing with transfers:

"Some customers may be unable to make transfers between accounts or pay someone using PayID or BSB and account number in NetBank and the CommBank app. Payments using cards and ATMs are fully available. We are working urgently to fix this issue and we thank customers for their patience and apologise for the inconvenience."

ASX flat at lunch as tariff uncertainty weighs

The Australian share market is tracking just slightly lower this afternoon, with the ASX 200 almost completely flat (or -0.01% to be precise) to 8,409 points at 1:25pm AEST.

That's probably due to caution following the rapidly changing news out of the US after a federal court granted a stay to President Donald Trump's "Liberation Day" tariffs until an appeal to a trade court decision to block them is heard.

It was a subdued session on Wall Street overnight too, and Asian markets are broadly lower today so far.

Capital.com market analyst Kyle Rodda sums up the sentiment:

"The caution reflects the fact that although market sentiment has been supported by the prospect of the judiciary halting arguably Presidential overreach with tariffs and trade policy, the decision marks the beginning of a new source of uncertainty rather than the total closure of another."

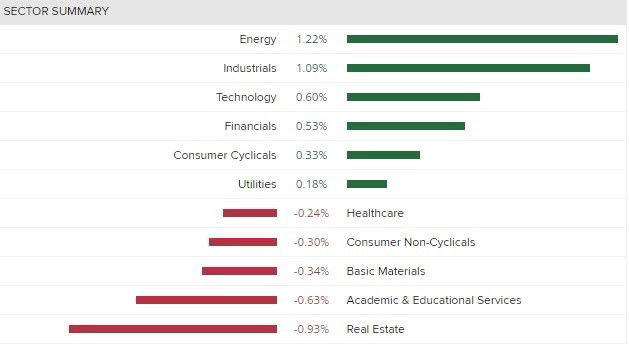

It's a fairly even split on the ASX 200 with five sectors in the green and six in the red:

Technology is leading the losses, down 1.3%, while education is 0.6% higher.

The Aussie dollar is 0.3% lower buying 64.25 US cents.

Are you experiencing online banking problems?

Nadia Daly here jumping on to the blog for a bit. As you've seen we're hearing there are problems with CBA online banking. Are you experiencing issues with Commonwealth or another bank? If so we'd like to hear from you. Please drop us a comment on the blog if you want to get in touch and share your story

Commonwealth Bank customers experiencing 'issue' with transfers

Australia's biggest bank is giving its online banking customers a this message when they log in right now.

It says customers might be having issues making transfers within their own accounts or to other people using PayID or BSB details.

The message says people can still make payments using their cards or withdraw cash at ATMs.

We've asked the bank for more information.

Are you a bank customer having issues right now? Email me on terzon.emilia@abc.net.au

Apartment slide pulls building approvals lower, as house approvals rise

The ABS has had a busy Friday, with several closely watched data sets out.

One of them is building approvals, given that the federal government is aiming for the nation to build 240,000 new homes a year over five years.

This is Oxford Economics Australia lead economist Maree Kilroy's take on the latest data:

"The latest ABS Building Approvals release showed national total dwelling approvals subsided 5.7% in seasonally adjusted terms to 14,633 in April," she notes.

"National private house approvals gained 3.1% to 9,349 off the soft March result. New South Wales (+7.3%) and Queensland (+7.3%) drove the gain, while the other major states held relatively flat.

"Private attached dwellings normalised further in April, down 19% to 4,999 — the weakest result since September 2024. New South Wales, Victoria and Queensland were all down. The fall back in apartments approvals is not a shock. We have been expecting a normalisation from the strong start to the year.

"There are a number of policy supports for housing in play including BTR tax concessions, social housing stimulus, low deposit loans, and infrastructure funding support. These will all help to boost supply, but it will take time for this to reflect more favourably in the dwelling approvals figures."

Kilroy says the two rate cuts already implemented by the RBA, and at least two more expected before the end of the year, are likely to see a rebound in building approvals.

It's just not likely to happen straight away.

"Additional support is likely from the RBA. Two more cash rate cuts are forecast before the end of the year that will further support mortgage affordability and project feasibilities. However, it usually takes about year for lower mortgage interest rates to support approval volumes."

Retail sales fall despite post-cyclone bounce in Queensland

The Australian Bureau of Statistics has just released its latest retail sales numbers, showing a 0.1% decline in turnover during April.

The ABS reported the largest falls in clothing, footwear and personal accessory retailing (-2.5 per cent) and department stores (-2.5 per cent).

This was partially offset by rises in other retailing (+0.7 per cent) and household goods retailing (+0.6 per cent).

"Clothing retailers told us that the warmer-than-usual weather for an April month saw people holding off on buying clothing items, especially new winter season stock," noted the bureau's head of business statistics, Robert Ewing.

Having underpinned recent growth, food-related spending continued to rise, with growth in cafes, restaurants and takeaway food services (+1.1 per cent). This was partially offset by a fall in food retailing (-0.3 per cent).

"The rise in food-related spending was driven by more dining out in Queensland this month. The bounce-back comes after adverse weather negatively impacted cafe and restaurant sales," Mr Ewing explained.

Ben Udy from Oxford Economics said the data showed Australian consumers remained very cautious, despite the RBA's first rate cut in February.

"The fall in sales values in April follows a weak 0.3% m/m rise in sales in March," he noted.

"Sales values in March were notably held back by a 0.4% m/m fall in sales in Queensland as consumers were forced to bunker down due to ex-tropical Cyclone Alfred. Today's data shows Queenslanders returned to the shops in April, but that rebound was offset by weaker sales across all other states.

"The weakness outside of Queensland may be related to the stalling in the recovery consumer sentiment due to rising global trade uncertainty."

Mr Udy thinks the Reserve Bank may have to cut sooner than he previously thought if consumer spending remains so subdued.

Viva Energy gets approval for Geelong LNG terminal amid gas shortage fears

Viva Energy says the Victorian government has cleared the construction of its liquefied natural gas (LNG) terminal project in Geelong, amid growing concerns over a potential gas shortage in the east coast of Australia.

The Australian government has been actively seeking gas supply commitments to help close the gap between supply and demand, following a warning from the country's competition regulator that the east coast may face a longer-term shortfall.

"We believe the LNG terminal is vital to ensure the secure supply of gas to the south-east market," chief executive Scott Wyatt said.

Winter in Australia, one of the world's largest LNG exporters, typically sees peak gas demand due to colder temperatures, with unexpected weather events or power plant outages increasing the risk of shortages.

The fuel retailer said the next step is a final investment decision, and it is currently collaborating with potential partners on structuring the project's debt and equity.

The current timeline targets first gas delivery from the proposed project in time for the Victorian winter of 2028.

Viva Energy's update was "welcome news", particularly in light of a potential surge in electricity bills, said Jessica Amir, market strategist, Moomoo Australia.

Ms Amir, however, said that the approval is unlikely to significantly impact the company's stock price, as it remains largely tied to movements in oil prices.

Viva Energy's shares were trading 1.5% lower, in line with a 1.1% decline in the Australian energy sub-index.

with Reuters

Healthscope landlord surges on partially deferring rental payments

Shares of Healthscope landlord, Healthco Healthcare Wellness REIT (HCW), rise 13% to $0.93, hitting its highest level since March 3 and set for its biggest single-day gain on record.

HCW says it has agreed to partial rent deferments on 11 Healthscope hospitals.

HCW, a satellite fund run by David Di Pilla's HMC Capital, says it would defer 15% of the rent due to Healthscope for May-August period until September.

The company adds it has received expressions of interest from alternative hospital operators to re-tenant the facilities.

with Reuters

Market snapshot

- ASX 200: -0.3% to 8,387 points

- Australian dollar: Flat at 64.42 US cents

- S&P 500: +0.4% to 5,912 points

- Nasdaq: +0.4% to 19,176 points

- FTSE: -0.1% to 8,716 points

- EuroStoxx: -0.2% to 548 points

- Spot gold: -0.1% to $US3,313/ounce

- Brent crude: -0.1% to $US64.10/barrel

- Iron ore: +0.2% to $US99.30/tonne

- Bitcoin: -0.3% to $US105,851

Prices current around 10:45am AEST.

Live updates on the major ASX indices:

ASX edges lower at open

The Australian share market has opened lower in a broad-based selloff.

The ASX 200 index was down 21 points or 0.3% to 8,388, by 10:30am AEST.

All 11 sectors were in the red, with energy (-1.5pc) and industrials (-1pc) leading the losses.

Here are the top and bottom movers in the first 30 minutes of trade.